The $50,000 Hidden Tax: Why Your Staffing Firm’s Cash is Always Stuck in Limbo

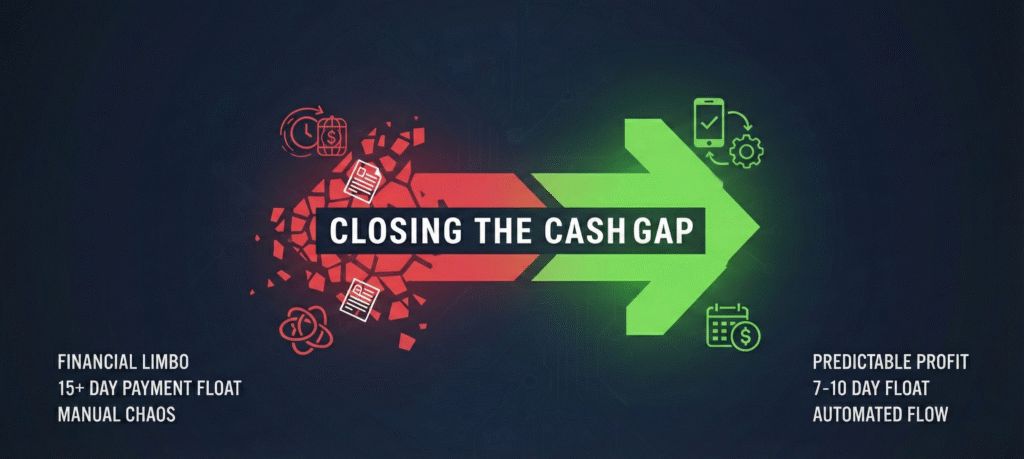

Let’s just be real for a minute. If your client payment float is regularly creeping past 15 days, you’ve got a massive, invisible problem. You aren’t just managing cash flow; you are an involuntary lender to your clients. Every Monday, you pay out your temps, creating a liability. But the revenue? It’s sitting, waiting, trapped in a slow-motion approval queue. That financial limbo—that delay—is the $50,000 hidden tax bleeding your profit margins.

If you run a serious staffing operation, you’re not managing a team; you’re managing chaos. You’re dealing with:

- A hundred different temps clocking in across a dozen client sites.

- The nightmare of specific client bill rates and constantly changing state overtime laws.

- The Friday afternoon panic where someone, always someone, is chasing an emailed timesheet from a client manager who’s “out until Monday.”

You know the drill. That desperate paper chase isn’t just inefficient; it’s where errors hide and compliance breaks down. We all know the real killer isn’t the recruiter fee; it’s the manual handoff between three different desks: the Temp -> The Client -> Your Accountant->Your automated payroll for staffing system. That handoff is killing your time-to-cash.

Forget “better software.” The real fix is a mental shift towards Closing the Cash Gap. The core principle? Approved Time must equal Billed Revenue. Period. We have to stop making time tracking an administrative chore and make it a financial trigger. The system needs to be designed to automatically handle the tedious stuff, making human intervention only necessary for exception management.

This is how we cut the float and close that cash gap—it’s not magic, it’s process:

- Step 1: Capture at the Source (No More Memory)

- What to do: Get temps clocking in/out via mobile or geofenced tools while they are on the client site.

- Why it matters: It removes the single largest source of error: the Friday afternoon memory dump. It also provides immediate proof for compliance.

- If you skip it: You’re stuck with handwritten notes or emailed spreadsheets that your team has to manually verify against the placement record.

- Micro-example: A temp clocks out at 5:01 PM; the system instantly knows the final hours were logged at the correct client location.

- Step 2: Stop Chasing, Start Auto-Routing

- What to do: Implement an automated, intelligent routing system for client approvals.

- Why it matters: This cuts approval time by days. We need an airtight timesheet approval workflow where the system reminds the client, not your account manager.

- What happens if you skip it: You perpetuate the “timesheet sat in spam” excuse, delaying the whole week’s revenue cycle.

- Step 3: Bake the Rates into the Clock

- What to do: Hard-code all pay rates, bill rates, and specific client rules directly into the time entry system.

- Why it matters: The moment the client hits “Approve,” the time is instantly calculated against the contracted rate, ready to be billed. No calculation errors, ever.

- Step 4: Pay & Bill, Simultaneously

- What to do: Use a unified system that instantly generates both the temp’s payroll file AND the client invoice from that one single, approved data source.

- Why it matters: This is the payoff. It shrinks a two-day back-office reconciliation process into a five-minute review, letting your automated payroll for staffing execute instantly.

Think about what really changes here. Before automation, we used to spend one full day every single week just reconciling mismatched spreadsheets—that’s $400-$600 in wasted administrative labor. Now? The payroll manager spends that same hour reviewing the exceptions only. That shift is why successful agencies can easily move from a 15-day float down to 7-10 days. That immediate cash injection is transformative.

I hear this all the time: “My clients won’t adopt new software.” That’s not the obstacle anymore. Modern time tracking software isn’t a complex ERP system; it’s a dedicated portal that makes the client’s life easier. They aren’t learning accounting software; they’re just clicking “Approve” on a clean screen, getting instant visibility into their temps’ hours. The real misconception is believing that your clients prefer manual, error-prone emails over a clean, compliant, automated process. They don’t.

The real core problem facing staffing isn’t the economy; it’s the administrative leakage that’s slowing down your cash. The new path is simple: Close the Cash Gap with end-to-end automation. If you follow this, you stop managing weekly risk and start operating a predictable, highly profitable cash engine.

If you are ready to finally close that cash gap and implement a smart, unified system—one that excels at managing complex bill rates and providing a seamless timesheet approval workflow—then you need a partner built for the modern staffing industry. Velorona specializes in this exact framework, unifying your front and back office so you can focus on making placements, not chasing data.