How AI Payroll Automation Helps Staffing Agencies Slash Processing Time by 80%

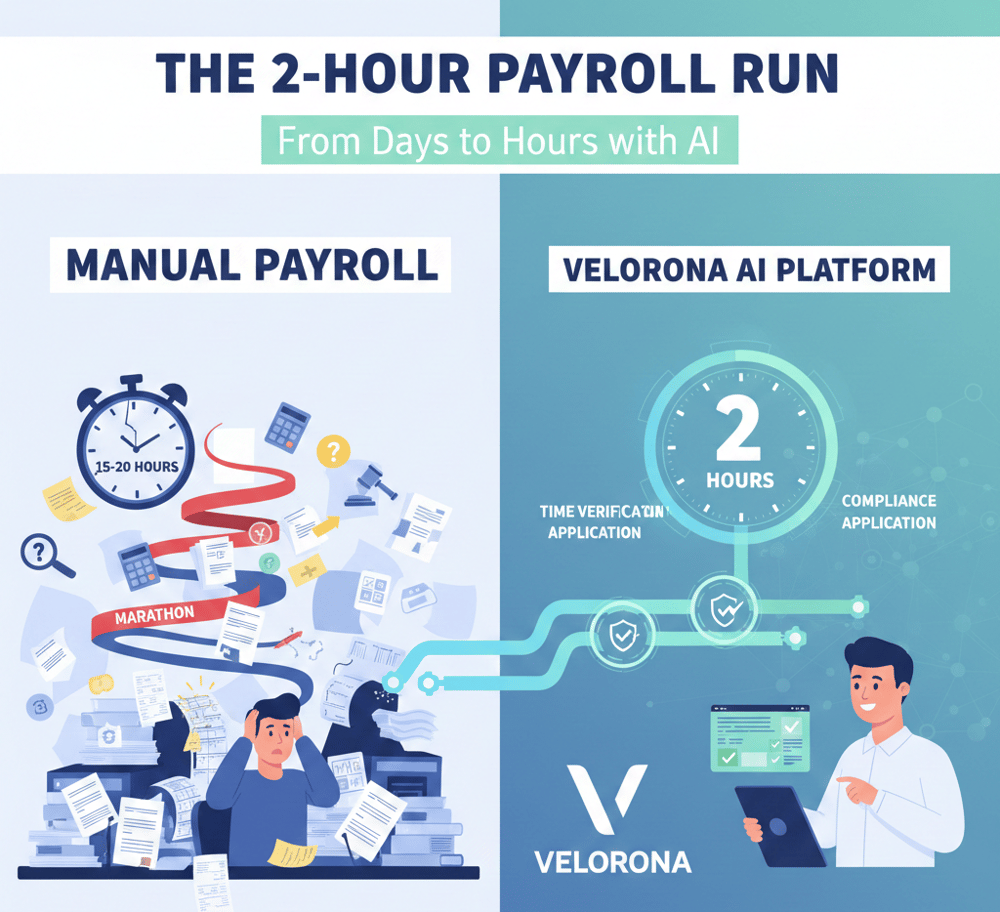

The 2-Hour Payroll Run:

How can I use AI to reduce payroll processing time from days to hours?

The short answer: By transitioning from fragmented, manual inputs (which consume 15–20 hours per cycle) to a Unified AI Payroll Platform like Velorona. Our system automates the three most time-consuming phases—Time Verification, Compliance Application, and Client Billing—allowing your team to process payroll with 80% greater efficiency, transforming a multi-day ordeal into a single 2-hour workflow.

The Hidden Cost of the Manual Payroll ‘Marathon’

For staffing, recruiting, and construction firms, payroll isn’t a simple calculation; it’s a relentless marathon of data consolidation.

Think about the traditional steps:

- Collecting timesheets (from various systems/spreadsheets).

- Manually verifying hours against schedules and GPS logs.

- Applying complex, state-specific overtime/break rules.

- Exporting data, fixing errors, and then manually generating invoices.

Each step is a bottleneck, a risk point, and a drain on your administrative team. The result is payroll that takes 2–3 days, diverting your team from high-value, strategic work.

This is why Velorona was built: To eliminate the chaos and deliver the confidence of an AI-powered 2-Hour Payroll Run.

Phase 1: Cutting Time with AI Time Verification

The biggest time sink is manual timesheet auditing. Did the employee actually work the hours claimed? Was the time coded to the correct client project? AI solves this by automating the validation process.

The Velorona Difference: Intelligent Discrepancy Flagging

Velorona’s AI engine doesn’t just check timesheets; it verifies them against multiple data points in real-time:

- GPS & Clock-In Data: Automatically cross-references claimed hours with the employee’s physical location at clock-in/out.

- Intelligent Anomaly Detection: The AI learns historical work patterns and flags only the entries that statistically deviate (e.g., an employee logging 16 hours unexpectedly).

- The 95% Automation: Instead of manually reviewing every timesheet, your payroll administrator is only notified about the 5% flagged exceptions, automating the approval of the other 95%.

By eliminating the manual “chase and check” cycle, this single step immediately reduces processing time by hours.

Phase 2: Removing Risk with Automated Compliance & Calculations

Compliance is where errors are most costly. Tax codes, minimum wage laws, and overtime rules change constantly, and manual application is a recipe for legal risk and fines.

The Velorona Difference: The Dynamic Pay Rules Engine

Our AI platform centralizes and enforces compliance rules instantly:

- Real-Time Rule Application: Complex labor laws (federal, state, and local) are applied automatically during the calculation phase. For example, if a worker crosses a threshold into mandatory double-time, the system instantly adjusts the pay rate without human intervention.

- Proactive Regulatory Monitoring: The Velorona system tracks legislative changes (tax updates, new labor laws) in real-time, updating the payroll engine without requiring manual configuration from your IT or payroll team.

This step ensures audit-readiness and guarantees accuracy, eliminating the time previously spent on retroactive fixes and compliance research.

Phase 3: The Seamless Finish Line: Integration to Client Billing

In traditional systems, the successful completion of payroll is immediately followed by the laborious process of manually transferring data to the invoicing system. This is often where the final, costly errors are introduced.

The Velorona Difference: Time-to-Invoice Automation

Velorona’s all-in-one platform connects the employee time, payroll, and client billing into one seamless digital thread:

- Payroll Finalized: Once the 2-hour run is complete, the final, verified labor costs are available instantly.

- Invoice Generation: The system uses the approved time and associated bill rates to automatically generate client invoices via the integrated Client Portal.

- Transparency: Clients receive accurate, itemized invoices instantly, reducing billing disputes and accelerating accounts receivable.

This final integration eliminates redundant data entry, making your financial cycle—from clock-in to cash-in—faster and more reliable.

The ROI for the CXO: Strategic Time, Not Administrative Time

The 2-Hour Payroll Run is not just about saving time; it’s about reallocating resources.

| Metric | Manual Payroll Process | Velorona AI Platform |

| Processing Time | 15 – 20 Hours | < 2 Hours |

| Error Rate | High (Human Error, Compliance Risk) | Near Zero (AI Verification) |

| Admin Overhead | Non-Strategic Burden | Strategic Resource |

By freeing your team from administrative quicksand, they can focus on higher-value tasks, like analyzing labor cost trends, managing critical vendor relationships, and driving client success.

Ready to Move from Days to Hours?

Stop paying the hidden cost of manual payroll. Request a personalized demo today to see how Velorona can deliver the confidence, compliance, and efficiency of the 2-Hour Payroll Run for your business.