How Automated Invoicing Shortens the Staffing Cash Cycle?

The Fastest Way to Accelerate Cash Flow and Unlock Growth in the Staffing Industry

In the US staffing industry, cash is the ultimate scaling constraint. Industry veterans often refer to this as the “Staffing Growth Trap.” It is a paradoxical cycle: the more successful you are at placing talent, the more capital you burn. Because you must front weekly or bi-weekly payroll for your workforce while waiting 30, 60, or even 90 days for client collections, rapid growth can ironically lead to a liquidity crisis.

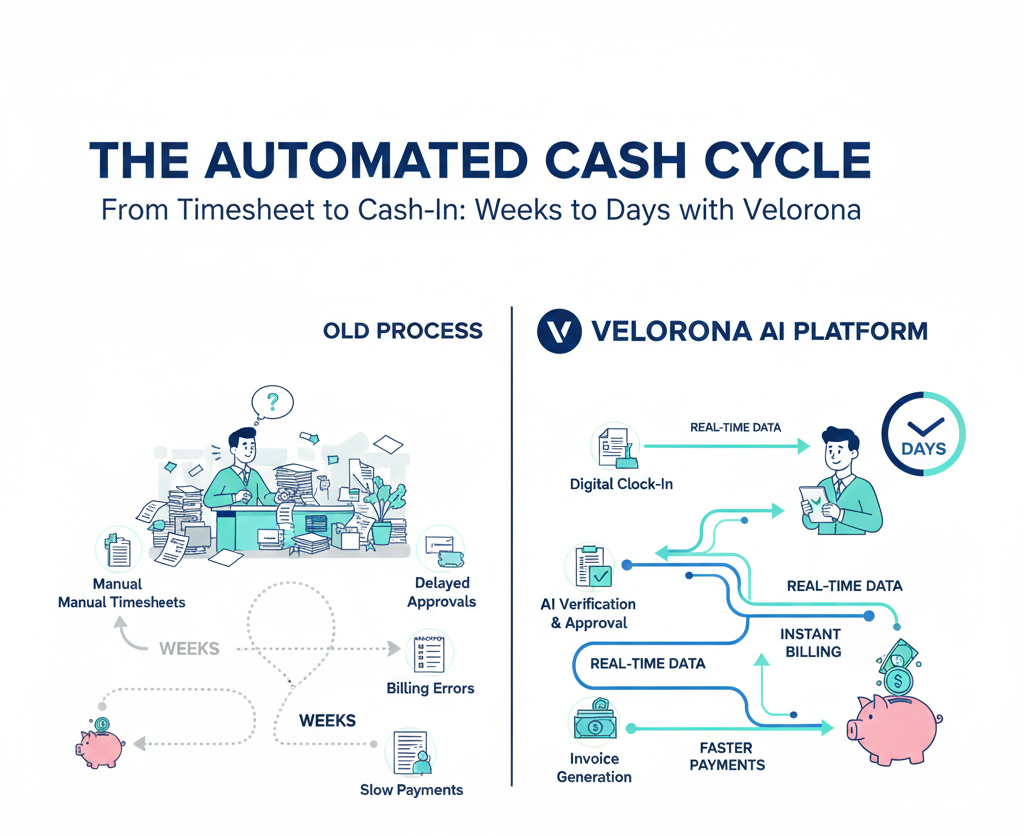

For the modern staffing firm, automated invoicing isn’t just an administrative upgrade—it’s a strategic financial lever. By leveraging a unified system like Velorona, which creates a seamless link between time-tracking and billing, agencies are shrinking their Days Sales Outstanding (DSO) by 15 to 20 days. This isn’t just “efficiency”; it’s the process of turning “trapped” receivables into immediate, reinvestable working capital.

Executive Summary for Agency Leadership

The Bottleneck: Manual “Timesheet-to-Invoice” cycles typically leak 5–7 days in administrative lag before the bill even reaches the client.

The Fix: Vertical integration between Time & Attendance, the ATS, and the Billing Engine (The Velorona “Engine” approach).

The Impact: A 50% reduction in invoice disputes and a significant boost in net-operating cash flow without adding back-office headcount.

I. The Anatomy of the “Staffing Growth Trap”

In the US market, the “Pay-Before-Collect” gap is widening. While payroll for W-2 or 1099 contractors is non-negotiable and immediate, enterprise client payment terms are increasingly pushed to Net-45 or Net-60. When you rely on manual invoicing, you aren’t just losing time—you’re increasing your Cost of Capital.

1. The Complexity of Variable-Input Billing

Unlike a standard SaaS subscription or a fixed-price product, staffing involves highly variable billing parameters. Manual systems fail because they cannot handle this complexity at scale:

Multi-Layered Approvals: In specialized niches like IT or Healthcare, a single contractor may require signatures from a project lead and a department head. In a manual setup, a “lost” email is a 7-day delay in your revenue cycle.

Format Fatigue: Large US corporations often require specific invoice structures for portals like Fieldglass or Beeline. Manually “massaging” data to fit these requirements is the #1 cause of transcription errors.

The Correction Death-Loop: A single $10 error on a $10,000 invoice often leads to the entire payment being held. In a manual world, correcting this resets the 30-day payment clock.

2. The “Hidden DSO” Lag

Many agency owners only measure DSO from the moment the invoice is sent. However, true efficiency accounts for the Full Cash Conversion Cycle. If your work week ends on a Sunday, but your team doesn’t mail the invoice until Thursday, you have a 4-day structural lag that automation—like Velorona’s real-time triggers—eliminates instantly.

II. The Mechanics of Acceleration: How the Velorona “Engine” Slashes DSO

To move the needle on cash flow, the invoicing process must move from a “Batch-and-Queue” system to a “Flow” system. This is where Velorona’s AI-powered automation transforms the back office.

1. Zero-Touch Data Synchronization

The goal is to create a “Single Source of Truth.” When your time-tracking software is natively linked to your invoicing engine, the data remains “clean” from the moment of entry.

Direct System Linkage: Once a client approves a time entry digitally within Velorona, a trigger is pulled. There is no transcription, no “export to CSV,” and no human intervention required.

Rule-Based Calculation: The system automatically calculates billable hours, applies the correct contract rate (including overtime markups or holiday differentials), and generates a compliant invoice in seconds.

2. Eliminating Approval Bottlenecks

The longest part of the cash cycle is often waiting for the client. Velorona’s Intelligent Approval Hub changes the dynamic:

Digital Tracking: Gain full visibility into which manager hasn’t signed off yet.

Automated Reminders: Precise, polite notifications are sent exactly when action is needed, eliminating the need for your finance team to “chase” paperwork manually.

Self-Service Portals: By giving clients 24/7 access to their own billing history and active invoices, you reduce support requests by up to 60%.

III. Strategic ROI: Why CFOs are Demanding Automation

Beyond “Speed to Cash,” there are three strategic reasons why US staffing firms are migrating to the Velorona platform.

1. Maximizing Finance Team Expertise

In a manual setup, your Finance Manager acts as a high-paid data entry clerk. By automating low-value tasks, your team can pivot to High-Value Financial Analysis:

Predictive Cash Forecasting: With a predictable cycle, you can accurately forecast cash positions with 90% accuracy.

Client Profitability Audits: Use Velorona’s real-time dashboards to see which clients have the highest “Cost to Serve” due to slow payments or high dispute rates.

2. Scalability Without Headcount

The “Old Way” of scaling an agency required hiring one back-office person for every $5M–$10M in billing. This eats into your margins. Velorona allows an agency to double its contractor count without adding a single person to the payroll department.

3. Professionalism as a Brand Advantage

In the B2B world, your invoice is a brand touchpoint. Punctual, accurate, and easy-to-read invoices signal an enterprise-grade partner. For agencies looking to land Fortune 500 contracts, your billing technology is often a prerequisite during the RFP process.

IV. By the Numbers: The Impact of Automation

To understand the financial impact, let’s look at a typical $10M/year staffing agency.

| Cash Cycle Stage | Manual Process | Velorona Automated Process | Time Saved |

| Time Entry to Draft | 3–5 Days | Minutes | 4 Days |

| Client Approval | 7–10 Days (Chasing) | 2–3 Days (Reminders) | 5 Days |

| Error Correction | 5–10 Days | < 1 Day (Pre-validated) | 7 Days |

| Total DSO Reduction | 16+ Days |

The Bottom Line: For a $10M agency, reducing DSO by 16 days unlocks over $400,000 in immediate liquidity that was previously “stuck” in the system.

V. Conclusion: Future-Proofing Your Agency’s Liquidity

The staffing industry is entering a cycle where operational efficiency is the primary differentiator. As talent becomes scarcer and client payment terms stretch, the agencies that survive will be those that treat their Invoicing Workflow as a competitive advantage.

By slashing your DSO by 15-20 days, you aren’t just “cleaning up the books”—you are injecting vital liquidity back into your business. These are the funds you use to outspend competitors on recruiter tools, marketing, and top-tier talent.

Ready to Accelerate Your Cash Cycle?

Don’t let manual processes act as a brake on your growth. Velorona was built by users, for users, specifically to solve the “Staffing Growth Trap.”

See a live demo of the Velorona Engine or start your Free Trial today and see how we can reduce your administrative overhead by 70% while getting you paid faster.

Frequently Asked Questions

1. How exactly does automation reduce Days Sales Outstanding (DSO)?

Automation targets the “Front-End” of the DSO cycle. Most delays happen before the invoice is even sent—waiting for timesheets, manual data entry, and chasing client approvals. By automating these steps, the “Invoice Date” happens days earlier, and because the data is pulled directly from approved time-tracking, the “Rejection Rate” (which resets the payment clock) drops to nearly zero.

2. Can Velorona integrate with my existing VMS or MSP portals?

Yes. Modern staffing SaaS platforms are designed to bridge the gap between your internal ATS and external client portals. By using standardized data exports or direct API connections, you can eliminate the manual “double-entry” of data into client systems like Beeline, Fieldglass, or Coupa, which is where most transcription errors occur.

3. What is the “Staffing Growth Trap”?

The Staffing Growth Trap occurs when an agency’s success outpaces its cash on hand. Because agencies typically pay contractors weekly but collect from clients every 30-60 days, every new placement increases the “payroll debt” the agency must carry. Without a fast, automated invoicing cycle to recoup that cash, an agency can actually run out of money while being highly profitable on paper.

4. How do automated reminders affect client relationships?

Surprisingly, they improve them. Clients prefer predictable, professional communication over sporadic “Where is my payment?” phone calls from a stressed finance team. Automated reminders are polite, consistent, and include all necessary documentation (timesheets, expenses, and invoices) in one click, making it easier for the client to say “Approved.”

5. Will I need to hire a technical expert to set up the Velorona Engine?

No. Velorona is built as a “No-Code” environment for staffing professionals. The system is designed to map your existing “Rate Cards” and client contracts into the automation engine, allowing your current team to manage a much higher volume of placements without technical training.